Shirley Erwee

Shirley Erwee

No More Pocket Money: Let Kids Learn to Earn

Pocket money teaches dependency instead of developing resourcefulness and entrepreneurial thinking. Discover innovative ways to inspire kids to learn to earn.

No pocket money is the key.

“No more pocket money?” you ask.

“Doesn’t that fly in the face of all the good advice about how to help children to manage money?”

There are countless books and websites that advise parents to teach children to be responsible with money. Many suggest having three jars set up and labelled for SAVING, GIVING and SPENDING. That’s not a bad concept, except for the source of the money.

I recently heard a mother share that her children were given pocket money as a privilege for being part of their family. If you look up the definition of the word “privilege” it refers to a special right or advantage for being part of a specific group. That does not sit well with me. Pocket money is not a special right. We don’t want any child to think that he or she is entitled to pocket money.

In a social media post, financial advisor Dave Ramsey stated: “You can’t raise financially responsible kids by handing them everything. Give them the dignity of work. Teach them that money comes from effort, not entitlement.”

In the 1800s, the orator, Frederick Douglass stated: "If you wish to make your son helpless, you need not cripple him with bullet or bludgeon, but simply place him beyond the reach of necessity and surround him with ease and luxury. This experiment has often been tried and has seldom failed."

If children never want for anything, what's going to motivate them?

Some advisors recommend offering children opportunities to earn their pocket money by paying the children to do regular chores in the home. In this way children are working for their money.

Don't pay kids to do daily chores.

Many families do this, but it’s not an effective system if you want to raise an entrepreneur. Firstly, it’s the childhood version of offering someone employment. They have to do what they are told and they collect their pay cheque. That will train your children to think like employees. Entrepreneurs need to develop vastly different character traits and abilities to employees.

Moreover, when children are paid for doing their daily chores, it trains them to believe that they should be paid for any work they are asked to do. They might become reluctant to do anything else, unless you pay them. You will have cultivated a sense of entitlement.

As parents, we don’t get paid for doing chores in our home. We make our beds, clean the bathroom, pack away laundry, tidy the kitchen, mow lawns and tidy up behind ourselves so that we can enjoy a neat and respectable home. We teach our children that they have to tidy up after themselves and do specific chores, which are their responsibilities too, because they are part of the family team and they live in our house. We all serve each other in some way or another. No one gets paid for daily chores. As adults, our children won’t get paid for keeping their own homes clean and tidy, so why now?

To make it easier to police chores, each child is assigned a specific chore that is theirs alone and no one else’s job. In this way, if it's not done, we know exactly who is responsible and there can be no blame shifting.

So how will kids learn about money, if they don’t get pocket money?

Pocket money is the childhood equivalent of social security.

In our home, we don't just hand out pocket money. We believe that would be the childhood equivalent of social security.

We don’t want to raise children to live on other people’s hard-earned money.

Successful, competent, independent adults have to earn their money and that is what we want our children to learn: money is earned. You earn it yourself.

Despite the many voices advising parents to give their children pocket money, there are some wise ones who agree with the “no pocket money” sentiment.

A homeschooling father and entrepreneur, Frank Muller agrees: “The biggest ‘danger’ to entrepreneurial raising is (paradoxically) financial security. So, do all in your power to remove financial security (no pocket money, get them to negotiate payment for tasks) while doing all in your power to reinforce the love you have for your children, regardless of their ‘success’ at business. Love breeds confidence, which breeds persistence, a crucial entrepreneurial ‘skill’.”

In a TED Talk titled, Let’s Raise Kids to be Entrepreneurs, Cameron Herold suggests a process that we use in our home too:

"Allowances teach kids the wrong habits. Allowances, by nature, are teaching kids to think about a job. An entrepreneur doesn't expect a regular paycheck. Allowance is breeding kids at a young age to expect a regular paycheck. That's wrong, for me, if you want to raise entrepreneurs.

What I do with my kids, nine and seven, is teach them to walk around the house and the yard, looking for stuff that needs to get done. Come and tell me what it is. Or I'll say, ‘Here's what I need done.’ And then, you know what we do? We negotiate. They go around looking for what it is [they can do], then we negotiate what they'll get paid. They don't have a regular check, but they have opportunities to find more stuff, and learn the skill of negotiating and of finding opportunities."

Entrepreneurs look for opportunities.

There is a subtle but very important difference here. The children have to THINK about ways to make money. They have to look for problems that they can solve. This is the paradigm of the entrepreneur. She looks for opportunities, she looks for ways to serve, she looks for ways to help other people and in the end, she changes the world and makes it a better place.

When a child finds something he can do, then he has to pitch the business idea to his prospective customer. Making a business proposal and presenting it is a skill that every entrepreneur requires. Setting a price or negotiating and closing the final deal, is also a skill to master. The child must learn to value his (or her) own time, labour and skill.

Your children won’t get a chance to develop these skills if you set out the jobs and set out the pay, like an employer in the workplace.

A few years ago, I shared this idea with my children: "Entrepreneurs provide solutions to problems that other people experience.”

Then I explained that I had a problem with weeds in our driveway and I needed a solution.

A volunteer quickly said he'd weed it for me.

"That's great, " I said, "but what's it going to cost me?"

In whispers, his dad then coached the little chap to negotiate a price. We haggled and I ended up agreeing to a price that was double the fee I had in mind at the start, but it was half the child’s initial asking price! We had both compromised before agreeing on his rate.

Of course, I could have done the job myself, but it was a good lesson in negotiation and selling services and my problem was resolved. The lesson was worth the price.

A year or so later, this same boy spent most of an afternoon creating a shop to sell some origami paper creations, plus some odd nick-nacks, he found around the house. He sold a few to his generous older siblings (we were a household of eight at the time) but he soon found that the market didn’t need his products.

(That’s a tough lesson for any business owner.)

But ever the entrepreneur, he looked for a solution to his problem. He asked if he could sell his goods on the sidewalk. His father advised him kindly that his products would be unlikely to sell there too.

Then the child and I had a productive conversation, as we considered questions that every entrepreneur, of any age, must answer:

What can I sell? What do people need or want?

Where is the best place to sell it?

What price will they be willing to pay for the product/s?

Grit, is a fascinating book about the power of perseverance, when we fail. Grit, the author and psychologist, Angela Duckworth declares, “depends on the expectation that our own efforts can improve our future.” An entrepreneur with grit doesn’t give up. He finds a solution.

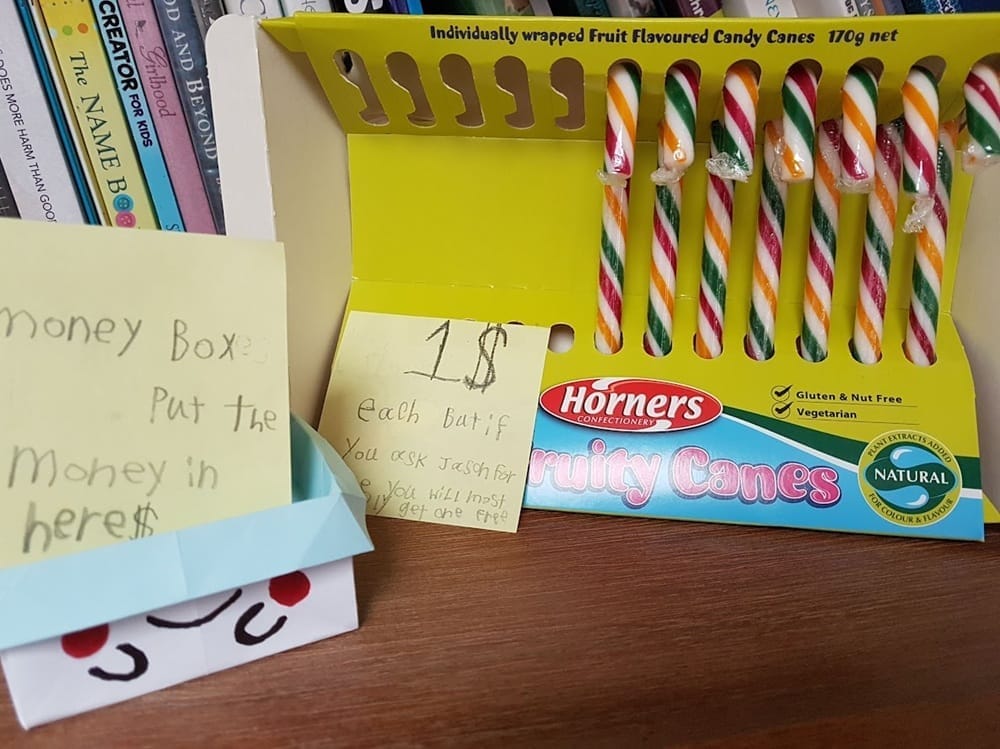

The next day, he took the little money he had and bought sweet treats that he knew the family liked. After dinner, he opened his tuck shop. In his immature handwriting he had scrawled the pricing for each of the products. He sold his wares at a small profit. He reasoned that he was saving the customers the hassle of driving or walking to the shop to buy their treats for themselves. His in-house tuck shop prospered. His initiative paid off and he learned some valuable lessons by actually setting up a business.

This is how children begin to learn the value of money.

At age 12, when he needed to raise funds for a ticket to an event, this same young man sold candy again. This time in a public venue…but that’s another story.

Once your children have earned their own money, then you can teach them how to manage it. Before they spend their earnings, advise and help them to draw up a budget. You can suggest that they put some pocket money away for savings, some for giving and keep some for investing in new ventures, so that it will multiply. Then let them have the pleasure of spending their money too. Allow them to learn from their mistakes. If they blow it all, that’s another lesson!

After they have spent some of it, ask them how much they spent, to train them to keep track of their money and be accountable. Record keeping is an important part of financial success.

I had to help my young son with writing down his expenditure, but he knew what it all meant.

Spenders, savers, schemers and dreamers

You will be surprised at how working with money reveals different character traits in each of your children.

In our home, one was a generous giver and a spender, another was a shrewd investor with plans to start a retail business and a third was a saver, who bought only useful products like stationery and his own nail-clippers!

Have a family discussion about each of your attitudes towards money. Some of us are savers, others are spenders, still others are schemers or dreamers. Sometimes we need a bit of all of the above! Being able to have healthy discussions and negotiations about money and how it should be spent or saved, is a valuable relationship skill.

No more pocket money!

We’re not raising dependent children, we’re raising productive, innovative adults!

Stay fired up for success with Shirley's

Entrepreneur Newsletter

Raising Job Creators

Keep up the momentum of building your family's financial education.

Don't lose your drive to take small daily steps to reach for big dreams.

Your privacy is secure.

You can opt-out anytime.

Categories

Raising Job Creators Newsletter

Subscribe to the newsletter and stay fired up for success! By joining, you acknowledge that you'll receive Shirley's newsletter. You can opt-out anytime hassle-free.

Copyright © 2025. Shirley Erwee. All Rights Reserved

Created with ©systeme.io